DOING BUSINESS AS AN UNINCORPORATED ENTITY

In some cases, members engage in organized officiating activity, including 1099 contracting services, without forming a nonprofit corporation to do so. The Information Guide contains information regarding legal liability protection afforded by incorporating. With the advent of limited liability companies, it may be possible to form a nonprofit entity as a limited liability company rather than as a corporation and still obtain legal liability protection. If incorporation or formation of a limited liability company is not done, the activity will likely be deemed to be engaged in by the involved persons as an "unincorporated association" (i.e., an organized body of people who have an interest in common). While not affording the participants and organizers limited liability (and therefore potentially exposing their personal assets to the liabilities and obligations of the activity), the activity nonetheless will typically involve elements of "engaging in business," including generation of revenues (whether by fund raising or charging of fees), incurring expenses, use of facilities and/or equipment and related agreements (whether or not in writing) and bookkeeping/accounting for the activities. Therefore, while the activity may be viewed as limited or informal in its scope or nature, issues such as tax reporting and insurance are still relevant. For example, an unincorporated association must have or use a federal tax identification number. If a separate number is not applied for and obtained, it may be necessary to use the social security number of one of the individuals involved in the activity. This is not a recommended approach, as it causes reported matters to be attributed to the individual, with potential unintended tax, financial or liability consequences. Therefore, while an unincorporated association may appear to be a simple and informal means to engage in an activity, it should be done with knowledge of its nature and potential consequences. Refer to the Information Guide for information about the formation and use of a nonprofit corporation in your activities.

In other cases, an association that exists as a nonprofit corporation may have different programs and activities that are conducted and/or managed separate from one another. An example could be a baseball and softball. These activities may have separate decision-making "boards" or committees, separate programs or events, separate travel schedules and arrangements, separate fees, separate use of facilities, etc. If so, they may (and typically do) have different risks and obligations associated with their activities. Therefore, it is generally advisable that associations with such activities evaluate the relative benefits and risks of engaging in differing activities under the umbrella of one nonprofit entity since, under such an arrangement, whatever are the risks of one activity will expose the other programs and related assets of the association to those risks. While insurance is intended to cover the various activities, it may be advisable to separately incorporate certain activities so as to insulate various assets and programs from others.

Of course, to do so will involve formalizing separate governance activities that will have resulting organizational, management, expense and political issues. The point here is not to advocate that separate incorporation of major, yet differing activities, be necessarily done, but rather to sensitize member association to the issues so that you may evaluate whether separate incorporation is advisable under the circumstances of your organization and its activities.

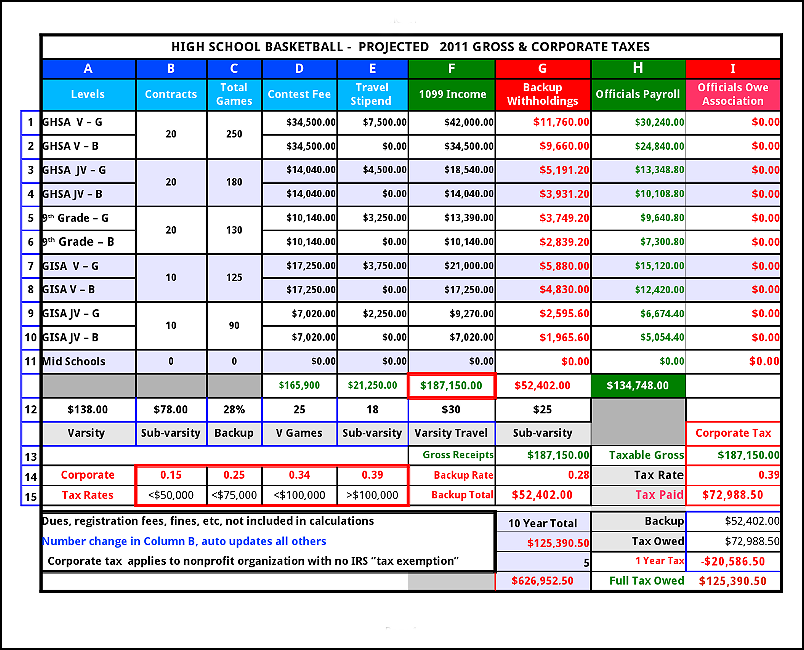

If the association has been in existence for 5 years or more. The association should be "incorporated" with the state and have IRS Determination Letter. Without either, the IRS considers the organization to be "for profit". As such, gross income becomes "taxable" under the corporate tax rates. The organization can remain "unincorporated", but it must have an IRS Determination Letter, if gross receipts for the calendar or fiscal year is $5,000 or more.

For further information regarding IRS rules and regulations and your particular tax or IRS situation you should consult with a Certified Public Accountant, licensed IRS Enrolled Agent, or professional tax advisor.

| Corporate Income Tax Rates

2011, 2010, 2009, 2008, 2007, 2006, 2005 |

||

|---|---|---|

| Taxable Income Over | Not Over | Tax Rate |

| $0 | $ 50,000 | 15% |

| $50,000 | $75,000 | 25% |

| $75,000 | $100,000 | 34% |

| $100,000 | $335,000 | 39% |

| $335,000 | $10,000,000 | 34% |

| LINKS TO CORPORATE TAX WORKSHEETS (hosted on Google DOCs) | ||||

|---|---|---|---|---|

| Associations | Baseball | Basketball | Football | Lacrosse |

| Officials | Schools | Soccer | Softball | Volleyball |