"Campaign To Protect Schools"

|

IRS Master File Data is available for download in two-part spreadsheet format. List all 501(c)(?) organizations for the state. Download Master File Data School Districts

Self-funded, No Gross Receipts. Web site hosted in Atlanta, Georgia

|

|

Reference GHSA Constitution and Bylaws paragraph 4.53

Contest officials and associations are independent contractors and not employees of the GHSA or GISA or its member schools. |

|

Superintendents, Principals, Bookkeepers

Athletic Directors, Coaches Protect Your School from Tax Fraud!! Get a signed IRS Form W-9 !! (No Form W-9 or Form W-9, No Exempt Payee = 28 percent tax withholdings) Sign 1099 Agreement For All Your School's Athletic EventsExempt Payee is not automatic, must have IRS Determination Letter Booster clubs has the responsibility to coordinate their payments with schools |

Your Community Requires You To

" Comply with IRS Requirements"

Have High School Officials Associations Register as 1099 independent contractors/vendors

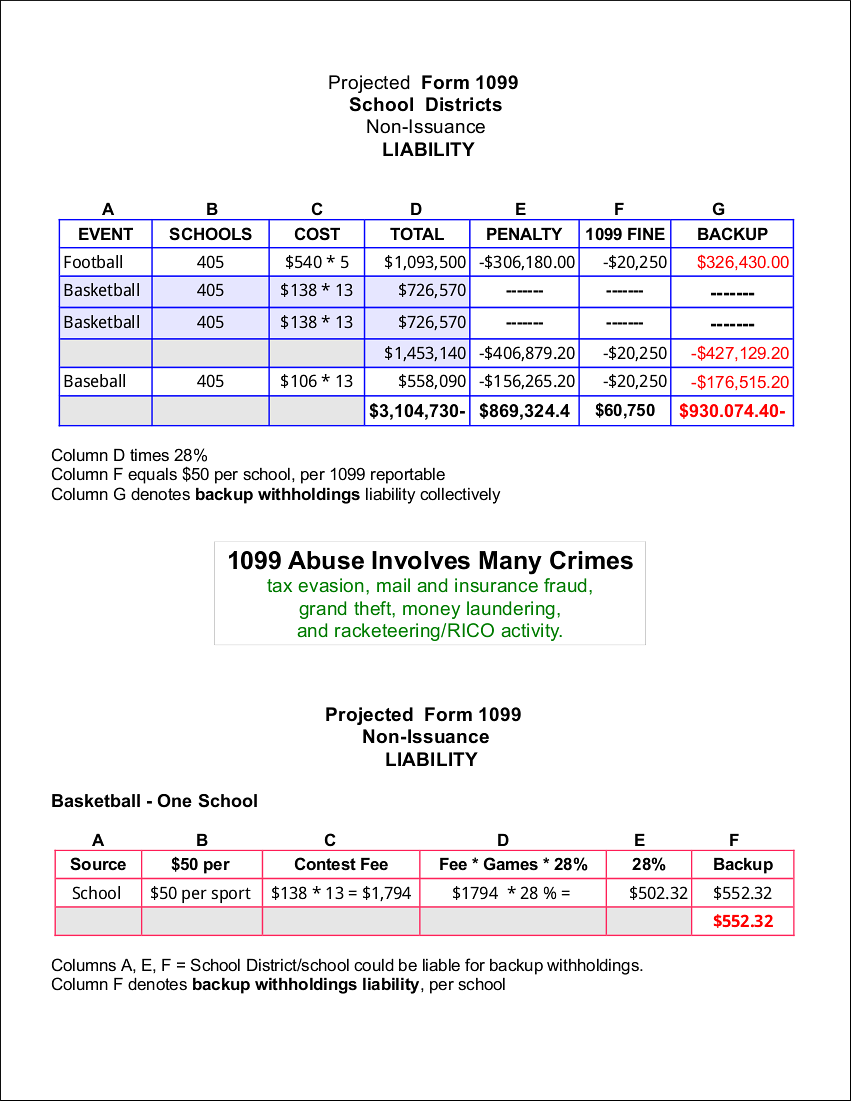

Failure to issue the required Form 1099

may result in your school district being liable for IRS penalty

1099 Abuse Involves Many Crimes

tax evasion, mail and insurance fraud,

grand theft, money laundering,

and racketeering/RICO activity.

Are school districts, schools, and booster clubs contributing to the "Underground Economy?

"Underground economy" refers to those individuals and businesses

that deal in cash and/or use other schemes to conceal their

activities and their true tax liability from

government licensing, regulatory, and taxing agencies.

Underground economy is also referred to as tax evasion, tax fraud, cash pay, tax gap,

payments under-the-table, and off-the-books.

School districts and booster clubs are required by federal law to comply with

Form 1099 and Form 1096

requirements

Consult with your district's CFO or accounting office for details

Your school district should have a 1099 policy, if not, YOU need to bring it to their attention

The payer (source) and recipient (independent contractor) are 1099 ACCOUNTABLE.

Info Links

Forms and Associated Taxes for Independent Contractors

Paying Independent Contractor

Independent Contractor (Self-Employed) or Employee?

Athletics Directors - Coaches Folder on Google Docs

"Feel Free to share this information with associates"

" Comply with IRS Requirements"

Have High School Officials Associations Register as 1099 independent contractors/vendors

Failure to issue the required Form 1099

may result in your school district being liable for IRS penalty

1099 Abuse Involves Many Crimes

tax evasion, mail and insurance fraud,

grand theft, money laundering,

and racketeering/RICO activity.

Are school districts, schools, and booster clubs contributing to the "Underground Economy?

"Underground economy" refers to those individuals and businesses

that deal in cash and/or use other schemes to conceal their

activities and their true tax liability from

government licensing, regulatory, and taxing agencies.

Underground economy is also referred to as tax evasion, tax fraud, cash pay, tax gap,

payments under-the-table, and off-the-books.

School districts and booster clubs are required by federal law to comply with

Form 1099 and Form 1096

requirements

Consult with your district's CFO or accounting office for details

Your school district should have a 1099 policy, if not, YOU need to bring it to their attention

The payer (source) and recipient (independent contractor) are 1099 ACCOUNTABLE.

Info Links

Forms and Associated Taxes for Independent Contractors

Paying Independent Contractor

Independent Contractor (Self-Employed) or Employee?

Athletics Directors - Coaches Folder on Google Docs

"Feel Free to share this information with associates"