"ROLLING THE DICE"

Which Do You Prefer To File??

Form 990 or Form 1120????

Which Do You Prefer To File??

Form 990 or Form 1120????

Unincorporated Local Associations

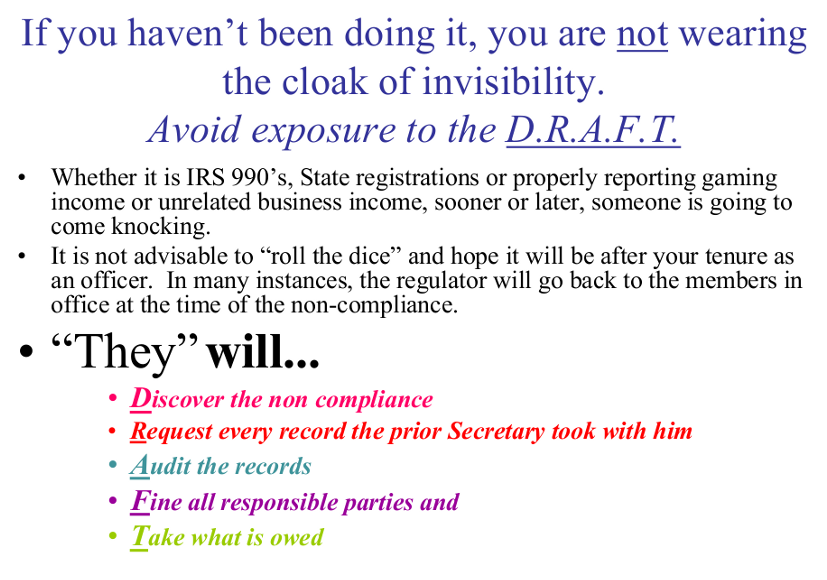

This type association has dues paying members, does not generate any income. Once they decide to outsource their officiating skills for high school and league contests. There status changes from no income to receipt of income. And should that income be over than $5000, they are required by federal law to apply for an IRS Determination Letter, requesting tax exemption as an unincorporated organization. IRS charges a fee for this action, so make good use of the dues that y members have been paying for years. Avoid the D.R.A.F.T.!!

Consult an attorney or a licensed IRS Enrolled Agent for assistance!!

Incorporated Association

Incorporated associations were once, unincorporated. This type association is registered with the state as a nonprofit organization. An association applies for, and pay a fee to the state, the state then issue an Articles of Incorporation certificate in the name of the association. The association must complete the action and become a legal 501(c)(3) nonprofit organization. The state cannot grant an association federal tax exemption. The association must submit correct forms to the IRS, pay the fee for this action. Normally, the timeframe to apply for an IRS Determination Letter, is within 27 months from the date on the state issued Articles of Incorporation. To simplify and have this requirement submitted, consult with a tax attorney or a licensed IRS Enrolled Agent

Avoid the D.R.A.F.T!!

This type association has dues paying members, does not generate any income. Once they decide to outsource their officiating skills for high school and league contests. There status changes from no income to receipt of income. And should that income be over than $5000, they are required by federal law to apply for an IRS Determination Letter, requesting tax exemption as an unincorporated organization. IRS charges a fee for this action, so make good use of the dues that y members have been paying for years. Avoid the D.R.A.F.T.!!

Consult an attorney or a licensed IRS Enrolled Agent for assistance!!

Incorporated Association

Incorporated associations were once, unincorporated. This type association is registered with the state as a nonprofit organization. An association applies for, and pay a fee to the state, the state then issue an Articles of Incorporation certificate in the name of the association. The association must complete the action and become a legal 501(c)(3) nonprofit organization. The state cannot grant an association federal tax exemption. The association must submit correct forms to the IRS, pay the fee for this action. Normally, the timeframe to apply for an IRS Determination Letter, is within 27 months from the date on the state issued Articles of Incorporation. To simplify and have this requirement submitted, consult with a tax attorney or a licensed IRS Enrolled Agent

Avoid the D.R.A.F.T!!