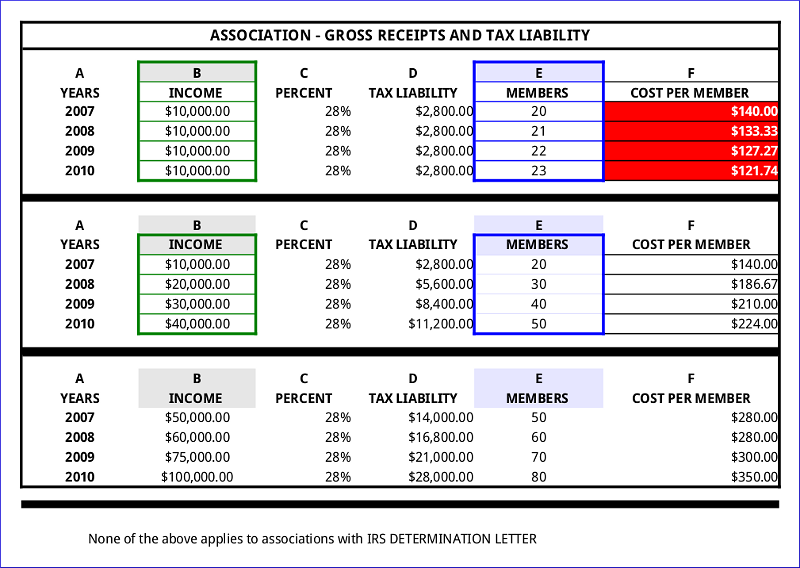

"ASSOCIATIONS TAX LIABILITY PROJECTIONS"

"Its best to comply than to pretend to be "UNAWARE"

Click image for a working spreadsheet hosted at Google Docs. Download or Open using your OpenOffice Suite

What about the financial penalties?

When it comes to assessing penalties against incorporated or unincorporated nonprofits for late filing or failure to file Form 990, the price tag is steep:

$20 per day up to $10,000 or 5% of revenue (whichever is less) for organizations grossing under $100,000 or;

$100 per day up to $50,000 for those grossing over $100,000.

Definitely not chump-change. In fact, it is enough to force the closure of many nonprofits.

courtesty of Foundation Group