"Constitution, Bylaws and Amendments"

"Its best to comply than to pretend to be unaware"

Articles of Incorporation

At least two documents are usually required to govern the operation of a nonprofit corporation. The Articles of Incorporation (may also be called the Corporate Charter, Certificate of Incorporation, Articles of Association, etc.). Generally considered the most important, it is a legal instrument which sets forth the name and purpose of the corporation and whatever other information is required by the laws of a particular state. The Articles of incorporation supersede all other rules of the corporation. The Bylaws, a document containing the corporation's basic rules relating principally to itself as an organization. (What today is preferred to be presented as a single document in times past may have been divided into two documents, i.e., the Constitution and the Bylaws). In accordance with the Official Code of Georgia Annotated, Title 14, Section 3-202, the Articles of Incorporation for the ______________________ Association, Inc., have been submitted to the Secretary of State, State of Georgia. Contained in these articles, among other things, are the corporation's:

Name

Incorporator

Place of business

Corporate and organizational bylaws regulate only the organization to which they apply and are generally concerned with the operation of the organization, setting out the form, manner or procedure in which a company or organization should be run. Corporate bylaws are drafted by a corporation's founders or directors under the authority of its Charter or Articles of Incorporation.

Bylaws generally cannot be amended by an organization's Board of Directors and Executive Committee. But there are cases where the executive committe (board of directors) plus 2 non-voting members have requested recommendations for additions, changes to the constitution and bylaws be sent to the secretary. The secretary turned the recommendations over to the executive board (board of directors) who chose what amendments the executive board wanted in or out. Such action removes the general membership from the process of debating. The executive committee is able to do that because an article in the constitution, some 15 years old, allowed it to be done. I challenged it by submitting a total rewrite of the constitution, only one article was included, the executive committee determines what goes into the constitution. A copy of the updated constitution was emailed to each member as, what they is term a first reading, convened a meeting, and voice voted the updated constitution. President and secretary failed to sign the constitution and bylaws in the present of the voting members.

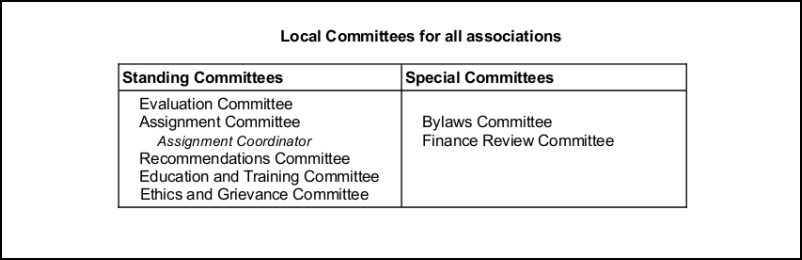

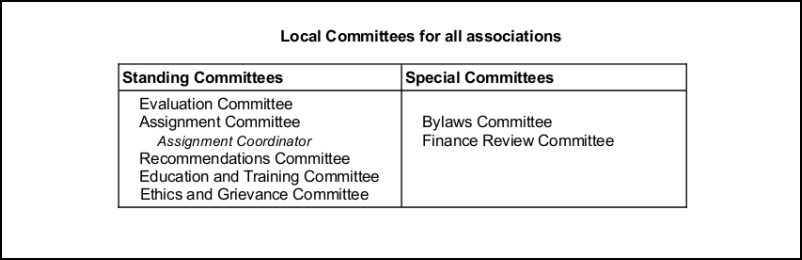

Technically there is no need for an executive committee. The board of trustees can appoint regular members to do the duties of the executive committee. The board of non-trustees will no longer have to wear two hats. The executive board, with board of non-trustees only hinders progress and improvements of an association. Executive committee should be dissolved and replaced with members from the general membership. The membership is better suited to put forth actions to improve the governing of the association. The below image shows the committees that regular members can serve on.

Minimum committee members should be 3, with one member servicing as chairman.

While an association's constitution and bylaws are its lifeline...it can also be what takes an association down. Improper bookkeeping is the number one area that gets associations in trouble. Bringing on unnecessary legal and tax problems, that could have been prevented...by doing it right from the start.

At least two documents are usually required to govern the operation of a nonprofit corporation. The Articles of Incorporation (may also be called the Corporate Charter, Certificate of Incorporation, Articles of Association, etc.). Generally considered the most important, it is a legal instrument which sets forth the name and purpose of the corporation and whatever other information is required by the laws of a particular state. The Articles of incorporation supersede all other rules of the corporation. The Bylaws, a document containing the corporation's basic rules relating principally to itself as an organization. (What today is preferred to be presented as a single document in times past may have been divided into two documents, i.e., the Constitution and the Bylaws). In accordance with the Official Code of Georgia Annotated, Title 14, Section 3-202, the Articles of Incorporation for the ______________________ Association, Inc., have been submitted to the Secretary of State, State of Georgia. Contained in these articles, among other things, are the corporation's:

Name

Incorporator

Place of business

Corporate and organizational bylaws regulate only the organization to which they apply and are generally concerned with the operation of the organization, setting out the form, manner or procedure in which a company or organization should be run. Corporate bylaws are drafted by a corporation's founders or directors under the authority of its Charter or Articles of Incorporation.

Bylaws generally cannot be amended by an organization's Board of Directors and Executive Committee. But there are cases where the executive committe (board of directors) plus 2 non-voting members have requested recommendations for additions, changes to the constitution and bylaws be sent to the secretary. The secretary turned the recommendations over to the executive board (board of directors) who chose what amendments the executive board wanted in or out. Such action removes the general membership from the process of debating. The executive committee is able to do that because an article in the constitution, some 15 years old, allowed it to be done. I challenged it by submitting a total rewrite of the constitution, only one article was included, the executive committee determines what goes into the constitution. A copy of the updated constitution was emailed to each member as, what they is term a first reading, convened a meeting, and voice voted the updated constitution. President and secretary failed to sign the constitution and bylaws in the present of the voting members.

Technically there is no need for an executive committee. The board of trustees can appoint regular members to do the duties of the executive committee. The board of non-trustees will no longer have to wear two hats. The executive board, with board of non-trustees only hinders progress and improvements of an association. Executive committee should be dissolved and replaced with members from the general membership. The membership is better suited to put forth actions to improve the governing of the association. The below image shows the committees that regular members can serve on.

Minimum committee members should be 3, with one member servicing as chairman.

While an association's constitution and bylaws are its lifeline...it can also be what takes an association down. Improper bookkeeping is the number one area that gets associations in trouble. Bringing on unnecessary legal and tax problems, that could have been prevented...by doing it right from the start.

Bylaws should include the following Articles:

1. Removal of board member(s)

2. Arbitration/Mediation Policy

3. Dissolution Clause

4. Officials Protection (Whistleblower) Policy

5. Committees and ad hoc committees

6. Reference to compensation or no compensation

7. Reference to policies and directives

8. No references to monetary amounts

1. Removal of board member(s)

2. Arbitration/Mediation Policy

3. Dissolution Clause

4. Officials Protection (Whistleblower) Policy

5. Committees and ad hoc committees

6. Reference to compensation or no compensation

7. Reference to policies and directives

8. No references to monetary amounts

Consult an attorney with nonprofit expertise or a credentialed Internal Revenue Service Enrolled Agent

for clarification of the state and federal requirements

for clarification of the state and federal requirements